The self-storage industry has become a trend in recent years. However, this trend is booming not only among individuals and businesses looking for alternative storage space but also among investors. The self-storage industry has already proven to be largely crisis-resistant worldwide during the global economic crisis starting in 2007 (financial crisis 2008). With the Corona crisis, the industry faced the next and new challenge. Many self-storage companies, such as MyBox, storemore, Space Plus and STOREROOM, are responding to changes in demand and user behaviour with digitization measures. It is likely that well-organised self-storage companies will survive the post-pandemic period and further crises without major damage.

Why Is Self Storage Recession-Proof?

There are several factors for the self-storage industry’s crisis resilience. Today, self-storage facilities are benefiting from the ever-increasing demand for storage space. The sector’s demand drivers include moving, decluttering, disasters, changing life circumstances and business purposes. These factors typically keep occupancy high and drive rental rates steadily higher. As a result, apartments are getting smaller and smaller, but the demand for more space is growing.

“In total, 4300 self-storages with almost ten million square meters of space can be found in Europe, with the United Kingdom having the most (over 1500). Norway has the highest density. There are over 44 storage facilities for every million inhabitants.” -Brenda Strohmaier, WELT

Projections for the period 2021 to 2026 suggest strong continued growth in the self-storage sector, particularly in urban centers and underpenetrated regions across Europe. As digital infrastructure expands and consumer awareness rises, markets such as Germany, France, and parts of Eastern Europe are expected to see an accelerated adoption of self-storage solutions. According to a 2021 report, the European self-storage market is projected to grow at a CAGR of 4.13% from 2021 to 2026, driven by increasing demand for flexible storage and urbanisation trends.

Key Self-Storage Requirements for Tenants, Operators, and Investors

Customer requirements for self-storage companies is just as interesting for private renters and companies as it is for investors. The basic requirement of tenants mainly refers to flexibility, scalability and security.

For investors and self-storage providers, the deposit period is the cornerstone of the requirements. When it comes to pricing, the main focus is on long-term customer loyalty. Factors that influence the costs for tenants in addition to the lease term are location of the storage facility, size and height of the rooms, and digitization measures. Another advantage for investors is the low maintenance of self-storage. Compared to other real estate investments, self-storage involves less maintenance. Due to modern technologies, such as software programs, with which the daily operation of the property can be controlled from anywhere. With the help of smart lockers, special monitoring systems and the option to sign documents online, it is possible to manage the facility without being on site yourself. This also reduces the need for a full-time property manager.

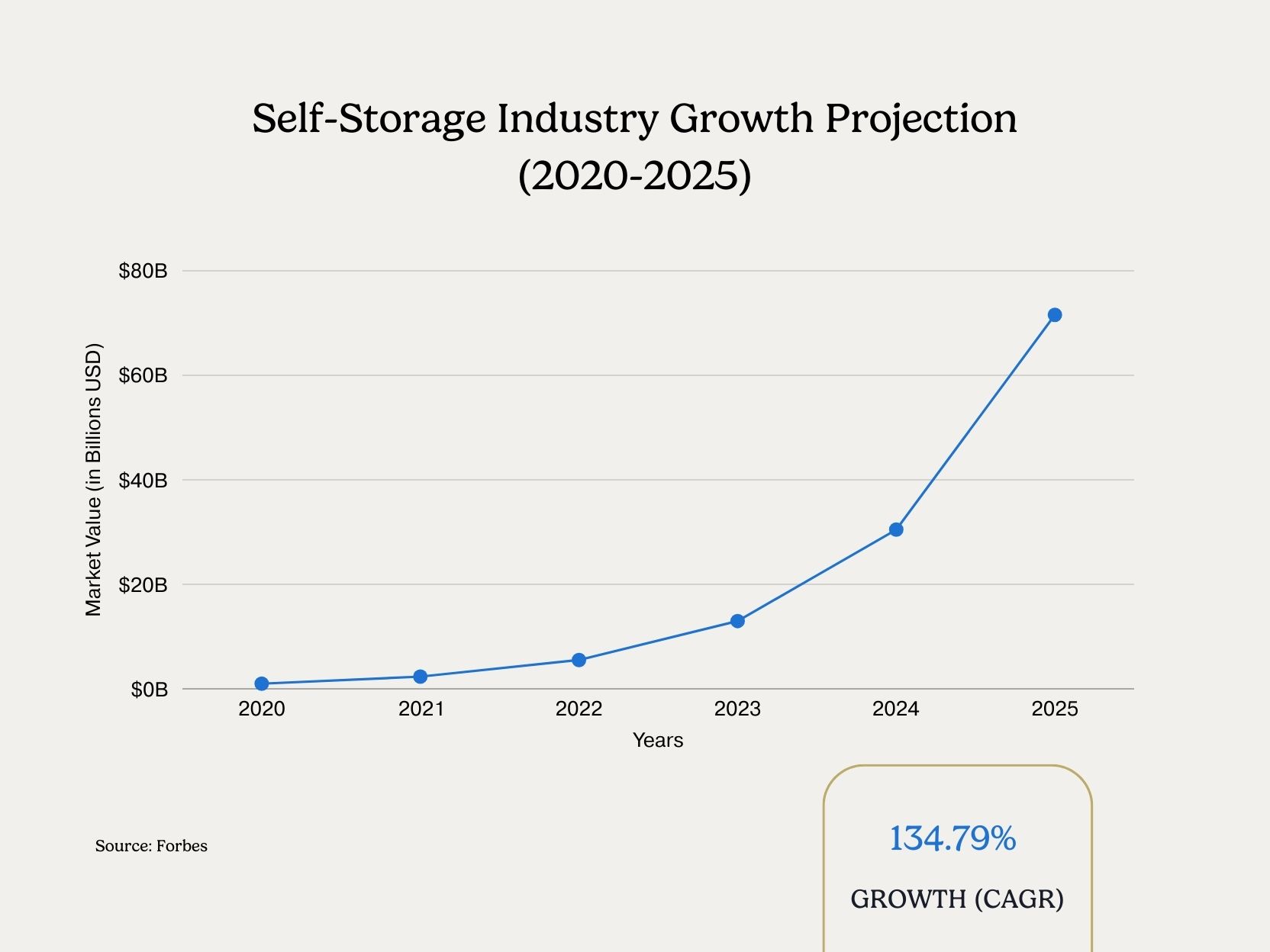

“Self-storage has proven to be recession-resistant and is projected to have a CAGR of 134.79% between 2020 and 2025.”- Forbes

In addition to financial performance, self-storage facilities are increasingly appealing to ESG-focused investors. Automated systems, low energy consumption, and minimal environmental impact compared to other real estate types make them a relatively sustainable asset class.

How Sensorberg’s Smart Technology Is Shaping the Future of Self-Storage

While for tenants, flexibility, security and scalability are the most important requirements for self-storage, for investors and operators, lease term is one of the most important requirements. However, the intersection between the two is pricing. Sensorberg’s technologies can guarantee security and flexibility. The digital self storage access control systems offer the flexibility of 24/7 opening hours and the assurance that unauthorized persons cannot access the storage facilities. The offline capability guarantees additional security. Sensorberg’s innovations reduce the need for a full-time property manager, saving additional time and money, making the property more attractive and successful for tenants, owners and investors.

Self-storage operators working with Sensorberg stand out by offering a fully digital, keyless rental experience. This aligns with evolving customer expectations for convenience, safety, and remote access—an edge that helps attract modern renters and scale operations efficiently.

Changing Customer Behaviour: Post-Pandemic Storage Needs

The COVID-19 pandemic reshaped how people live and work—bringing lasting changes to self-storage demand. Remote work trends led many to repurpose home spaces, while the e-commerce boom created short-term storage needs for small businesses. This shift in lifestyle and business operations continues to drive occupancy and push operators toward more flexible, tech-enabled solutions using self storage technology and advanced self storage monitoring capabilities to stay competitive.

Conclusion: A Resilient Industry for the Future

With strong demand drivers, low maintenance requirements, and growing investor interest, the self-storage industry continues to prove its resilience in times of crisis. As the sector evolves, digital innovations like Sensorberg’s access control technology are shaping the future of self-storage—making it more secure, efficient, and adaptable. Whether you’re a tenant, operator, or investor, the future of self-storage looks both stable and promising.